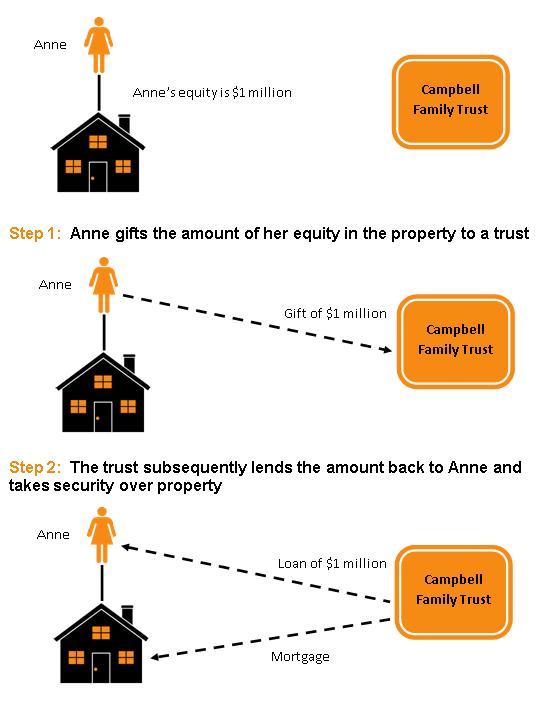

The ‘gift and loan back’ approach involves the owner of an asset gifting their equity in the property to a family trust (or low risk spouse).

The family trust then lends an amount of money to the owner and takes a secured mortgage over the property.

How does it work?

As an example, assume that Anne holds 100% of an investment property and the current value of the home is $1,500,000. There is an existing mortgage of $500,000.

How does this approach protect the equity in the property

Under a gift and loan back, any net equity in a property is protected by a registered mortgage. For example, if the property is currently mortgaged, say to a bank, the family trust will take a second registered mortgage. The bank still has priority under its first registered mortgage.

If the property is not currently mortgaged, the family trust will take a first registered mortgage.

In either case the full value of the property is protected by registered mortgages.

Ideally, the gift and subsequent loan should involve a physical transfer of funds, for example, by way of electronic funds transfers. While a physical transfer is the preferred approach there are other alternatives that can be available, depending on the circumstances.

What happens when the equity in property increases

If the value of the property increases, or debt to an external financier is reduced, the loan arrangement should be ‘topped up’. This can be easily done by (in the above example) Anne gifting further amounts equal to the increased equity amount to the trust. It is important to note that the gift of the increased equity will be considered a separate transaction for the purposes of bankruptcy clawback period rules.

What are the advantages of this approach

The advantages of utilising a gift and loan back approach, compared to a straight transfer of the property can include:

- The arrangement achieves broadly equivalent protection for the asset compared with a straight transfer, and

- As there is no change in the legal ownership of the property, transfer duty and capital gains tax will generally not apply. The only transaction cost should be a mortgage registration fee.

What are the disadvantages of this approach

The disadvantages of utilising a gift and loan back approach, compared to a straight transfer of the property can include:

- The arrangement is more complex than a simple transfer, and involves the preparation of additional documentation (including a deed of gift, loan agreement and security/mortgage documentation)

- It only protects the amount of net equity in the asset at the time of gifting – as mentioned above, it will not protect increases in the value risk the individual holds in the asset, and

- The arrangement is subject to the bankruptcy clawback rules and specialist advice should be obtained in relation to the operation of these provisions.

Summary

The gift and loan back strategy is an effective method of increasing asset protection where a direct transfer of an asset is not desirable or appropriate, for instance, due to prohibitive tax and stamp duty costs.

Disclaimer

This information is of a general nature and should not be viewed as representing financial advice. Users of this information are encouraged to seek further advice if they are unclear as to the meaning of anything contained in this article. We accept no responsibility for any loss suffered as a result of any party using or relying on this article.