When investing on behalf of a Self Managed Superannuation Fund (SMSF), you may have the option of:

- Holding all assets in one investment pool to meet the fund’s overall objectives (the un-segregated assets approach).

- Separating assets into two or more pools to meet the specific objectives of members of accounts within the fund (the segregated assets approach).

Here we take a look at the advantages and disadvantages of both options.

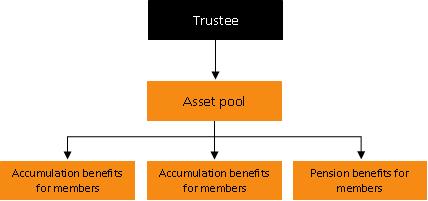

Un-segregated assets approach

The un-segregated assets approach involves holding only one pool of investments to meet the fund’s overall objectives.

This investment pool:

- Is used to fund all lump sum and pension benefits, as well as expenses of the fund; and

- Determines how the accounts of the fund members change over time on a proportional basis.

Un-segregated assets approach

What are the advantages of the un-segregated assets approach?

- The time, effort and cost required to administer and maintain your fund’s investments may be lower because the fund has only one pool of assets.

- The investment costs of the fund may also be lower because of the economies of scale that come with having a relatively larger level of assets in your asset pool.

- Holding one asset pool ensures that investment earnings and expenses are share equally between all fund members and accounts.

What are the drawbacks of the un-segregated assets approach?

- Where the fund has accumulation accounts and is paying pensions, a proportion of any income and net capital gains realised will be assessable for income tax purposes. You will need to obtain an actuarial certificate each financial year to determine the level of income that is exempt from income tax.

- You may be unable to cater for the different investment preferences of multiple fund members.

- It may be more difficult to cater to the often different requirements the fund has when paying pension benefits and managing accumulation accounts.

- Some apportionment will be necessary if certain expenses are incurred partly in deriving assessable income and partly in deriving exempt income.

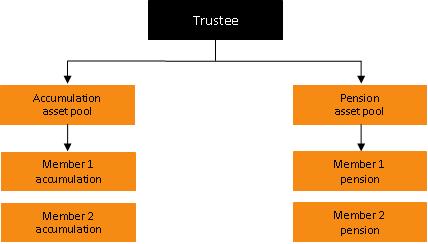

Segregated assets approach

The segregated assets approach involves holding two or more pools of investments to meet the fund’s objectives. This could include:

- Holding separate pools of assets to support pension accounts and accumulation accounts within the fund.

- Holding separate pools of assets to support the different investment preferences of members (or groups of members) within the fund.

Segregating pension assets

What are the advantages of segregating pension assets?

- Income and capital gains realised on your pension asset pool are fully exempt for income tax purposes.

- Where the fund has accumulation accounts and is paying account based pensions, no actuarial certificate will be required to determine the level of income that is tax exempt.

- Asset pools can be individually structured to meet the specific objectives of pension or accumulation benefits.

What are the drawbacks of segregating pension assets?

- The time, effort and cost required to administer and maintain your fund’s investments may be higher because the fund has multiple pools of assets.

- Income, expenses, capital gains and losses are to be separately determined and contained within each asset pool. For example, where the fund’s pension asset pool realises a net capital loss, it cannot be used to offset against any assessable capital gains in the fund’s accumulation asset pool (whether it be for current year or future years).

- It is not possible to segregate part of an indivisible asset (e.g. direct property).

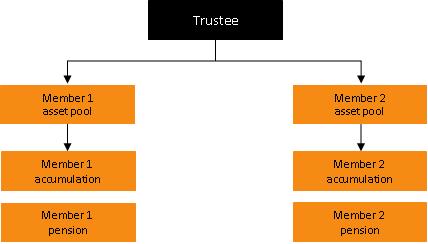

Segregating between members

What are the advantages of segregating between members?

- Asset pools can be individually structured to meet the specific objectives of each member or group of members.

- Each member’s asset pool impacts only on their benefits, allowing fund members to have greater control over the investment of their super benefits.

- Fund expenses associated with a particular member’s asset pool will impact only on that member’s benefits within the fund.

What are the drawbacks of segregating between members?

- The time, effort and cost required to administer and maintain your fund’s investments may be higher because the fund has multiple pools of assets.

- The investment costs of the fund may also be higher because of the lower balance in each asset pool.

- Where each member’s asset pool is supporting both pension and accumulation accounts, you will need to obtain an actuarial certificate each financial year to determine the level of income that is exempt from income tax.

Important considerations

It is important to ensure your fund’s trust deed and investment strategy allow for your chosen approach to structuring the fund’s assets.

Where you are electing to segregate the fund’s investments into two or more asset pools, it is important to follow any procedures required in your trust deed. A segregation of assets will also generally need to be put in place by trustee resolution. Your fund administrator can assist with these procedural issues.

It is also important to discuss the income tax consequences of your intended asset structure with your accountant or tax adviser.

Please contact our office if you would like further information on the topics discussed in this article.