Insuring your car, home or other possessions makes sense. So why do so few of us insure ourselves? If illness or injury stopped you from working for an extended period, could you keep paying your bills? Personal risk insurance gives you peace of mind that if the unexpected occurs, you and your family will be provided for.

What is personal risk insurance?

Personal risk insurance is an important way of ensuring you and your dependants will be financially supported in the event of serious illness, disability or death. If your ability to earn an income is affected, a personal risk insurance policy may enable you to maintain your current lifestyle and continue supporting those who depend on you.

Why do I need it?

While we recognize the emotional impact of events such as serious illness or death, the financial consequences can be equally devastating. If the unexpected did occur, having personal risk insurance can go a long way to helping you and your family meet your basic living expenses such as your mortgage, groceries, petrol or school fees. Depending on the event, you may also need to cover significant medical expenses, rehabilitation, modifications to your home or services to help maintain your lifestyle.

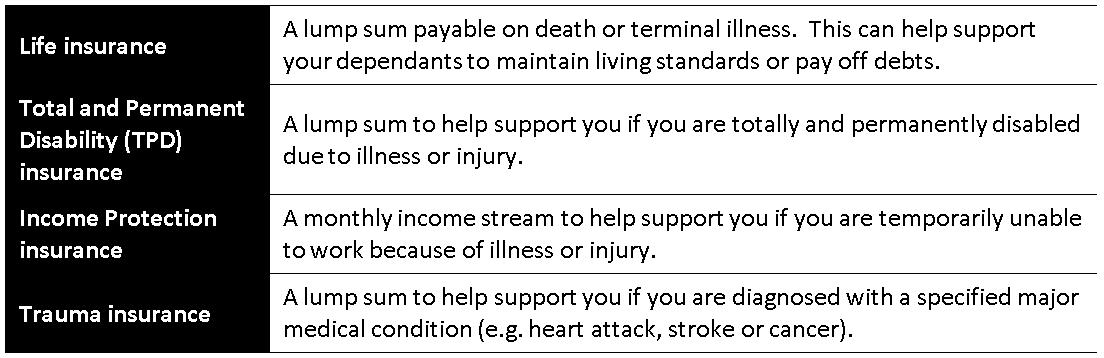

Types of personal risk insurance

There are four main types:

Life insurance

Life insurance can help provide financial assistance for a family if they lose the homemaker or breadwinner. In a business situation, life insurance can help protect against the loss of a key employee or business partner.

Total and Permanent Disability (TPD) insurance

TPD is designed to help meet one-off and ongoing living expenses, as well as cover special expenses such as medical and rehabilitation costs. To receive a TPD insurance benefit, you must satisfy specific criteria to establish the genuine nature and extent of the disability (this can vary between insurers). These criteria usually include a range of permanently disabling conditions specified in the policy, such as paraplegia, as well as more general criteria relating to your total and permanent inability to work.

Income Protection insurance

Income protection insurance, also known as salary continuance insurance, pays a monthly benefit of up to 75% of your pre-tax salary if you are disabled due to an illness or injury for longer than the nominated waiting period. Income protection benefits begin after a predetermined waiting period (e.g. 30 days, 90 days or two years) that you nominate when you take out the cover. Generally, a longer waiting period means a lower premium however it also means you’ll have to wait longer to receive your first benefit payment. The policy will continue to pay the benefit for as long as you remain unable to work up to a maximum predetermined period. This can be a set timeframe such as two years or age based (e.g. up to age 65).

Trauma insurance

Trauma insurance provides a lump sum payment if you suffer a serious, debilitating medical condition (as specified in the policy you choose) such as heart attack, cancer or stroke. Trauma insurance is designed to help people cope with the financial impact of a traumatic event as they recuperate. Generally, you will receive the trauma benefit provided you survive for a set period after incurring the condition.

It is important to note that different policies may have different features and you can access certain types of insurance through your super. Talk to your Financial Adviser for the most appropriate insurance to suit your individual and family needs.

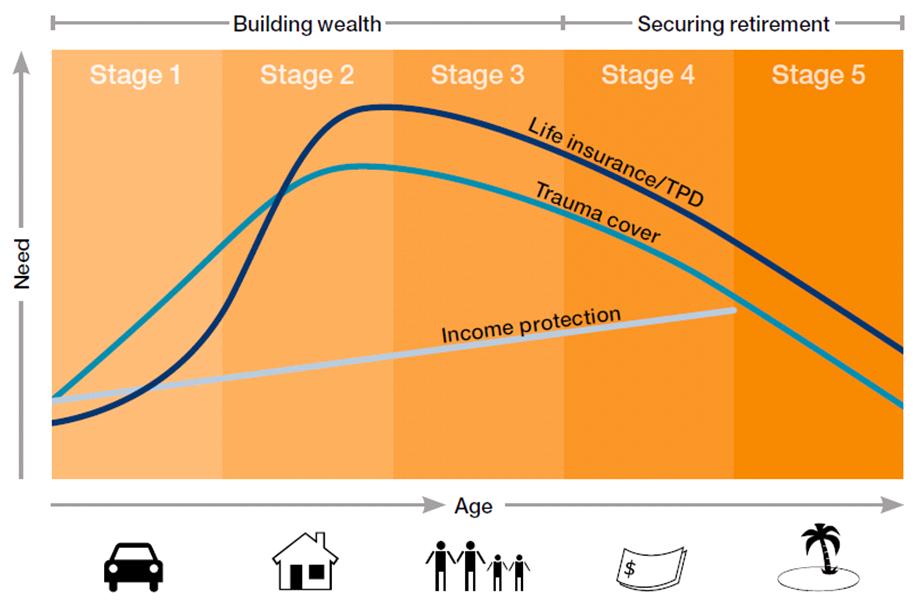

What kind of insurance do you need and when?

As your lifestyle and financial position change over time, so do your risk insurance needs. For example, during the years when you are supporting a young family or paying off a large mortgage, you will likely want more protection than later years when you may have downsized homes and your children are in the workforce. The diagram shows what type of insurance may be required most during each phase of life.

Can you afford personal risk insurance?

When you consider your existing financial commitments and level of savings, how long could you be without an income before you would need to sell the house or change schools?

The cost of premiums for any personal risk insurance policy reflects both the risk (probability) of an insured event occurring and specific features of the policy. Some typical risk factors are your age, the state of your health, your occupation and the type of recreational activities you participate in.

Some policy features may include:

- The amount of benefit payable upon claiming

- The waiting period before benefits are paid

- How long benefits will be paid out for.

Before taking out personal insurance, consider the policy features carefully and seek professional advice.

Insuring through superannuation

Acquiring life insurance through your superannuation fund can provide some tax concessions which are not generally available for life insurance policies held ‘outside super’. For example, by claiming a tax deduction for personal contributions to superannuation or making salary sacrifice contributions from your pre-tax income, you can effectively pay your insurance premiums from your pre-tax income. This could make it significantly cheaper (on an after-tax basis) for you to insure through superannuation. Also the trustee of the superannuation fund may be able to claim a tax deduction on the premiums for life, TPD and income protection insurance. This could also reduce the cost of cover.

Tax considerations

Note that these contributions are subject to the concessional contribution caps. If these caps are exceeded, a tax of 31.5% applies to the excess amount in addition to the standard 15%. When insuring through superannuation, if life insurance benefits become payable they attract a tax liability of 31.5% if paid as a lump sum from a super fund to a non-dependant. However where life insurance benefits are paid to a dependant, they are tax-free. Benefits for income protection acquired through superannuation are taxed at normal marginal tax rates. TPD insurance may attract tax as a superannuation life benefit.

The importance of policy ownership

Whether you are taking out risk insurance yourself, with your spouse or with a business partner, ownership of the insurance policy is an important consideration. There are different policy ownership options available. Each one can give a different outcome in certain circumstances. We recommend you seek professional advice on the structure that suits your goals and objectives.

Ways your adviser can help

- Your Financial Adviser can help decode the various insurance policies and find the right mix of cover to suit your needs.

- They can outline the pros and cons of waiting periods, different insurance providers and premiums.

Based on your current investment portfolio and earnings they can ensure your level of income is protected should the unexpected happen – so your family have financial security and you can recover in comfort.