Insurance is an important consideration for all of us. But for SMSF trustees, there is also a legal requirement to consider the need to hold insurance cover for each of their members. This article will give you valuable information that you need to know about holding insurance through your SMSF.

What are the advantages of holding insurance through your SMSF?

Save money on your premiums

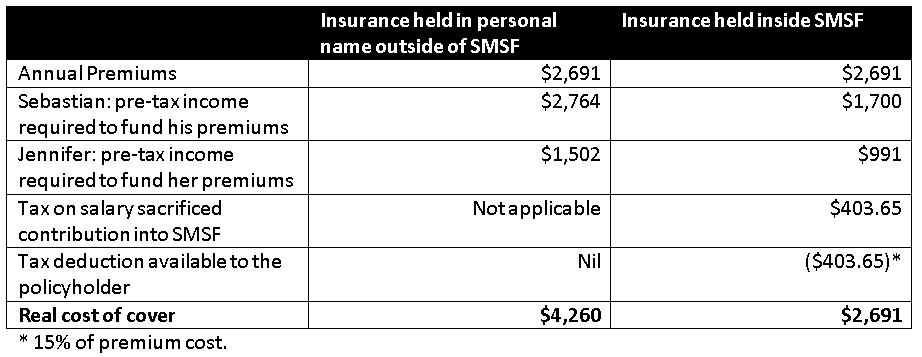

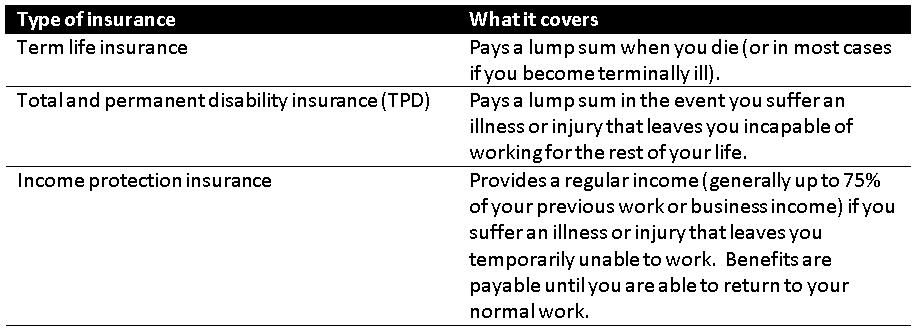

If you hold life and total and permanent disability (TPD) insurance through your SMSF, the premiums will generally be tax deductible. So premiums for life and TPD policies held inside your SMSF will generally be cheaper than for those held outside your SMSF (where the premiums are generally not tax-deductible). However unlike Life and TPD Cover, Income Protection is generally ‘tax deductible’ to the policyholder (such as when you hold it in your own name outside of super). Because of this, there is no tax saving on premiums to holding Income Protection insurance inside super.

You can either make additional contributions to your SMSF to pay for the premiums or they can be paid from your existing superannuation balance.

Are there any disadvantages?

The downside of funding insurance using your super balance is that you will be reducing your existing retirement savings.

Also, if you were to fund the insurance premiums by salary sacrificing to your SMSF, you need to be careful that you do not exceed the concessional contributions cap (currently it is $25,000 although this may change in future years). Otherwise, you may incur additional tax liabilities.

In some cases, tax could apply to insurance proceeds included in a benefit paid from the fund. This will depend on you or your beneficiaries’ circumstances. For example:

- Life insurance proceeds paid as part of a lump sum death benefit to a spouse will be tax free, while proceeds paid to a non-dependent adult child will generally be taxed at up to 31.5%.

- TPD proceeds paid out to the life insured from the super fund, will be taxed as a superannuation disability benefit.

Finally, it is important to check that your SMSF Trust Deed is up-to-date and includes all relevant objectives and current superannuation legislation.

Let’s look at how it works – a case study

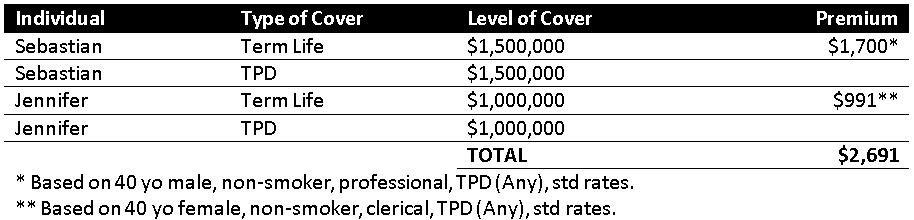

Sebastian and Jennifer are a married couple in their 40s with two young children. Sebastian earns $120,000 per year and Jennifer earns $60,000 per year, so their marginal tax rate is 38.5% and 34% respectively (this includes the Medicare levy). They have decided to both take out term life and TPD insurance, and have agreed that should the unexpected happen to either of them, the death benefit will be paid to the surviving spouse to assist the family in maintaining its current standard of living.

The level and cost of cover are detailed in the following table:

In obtaining their insurance cover, Sebastian and Jennifer have two options:

- Hold the cover in their personal names (outside of super) and pay for it directly through their after-tax employment income; or

- Have their SMSF acquire and hold the insurance on their behalf, and fund the premiums via salary sacrifice contributions from their respective pre-tax employment incomes.

Comparison between holding the insurance inside and outside of SMSF

Outcomes

Sebastian and Jennifer decide to take out their insurance using their SMSF. This means they can:

- Save $1,569 on the total premiums of the cover by having the insurance policies inside their SMSF in contrast to holding the insurance policies in their personal names.

- Pay their premiums by salary sacrificing into their SMSF, effectively funding the premiums through their pre-tax income.

Where the Life insurance proceeds are to be paid to the surviving spouse via the SMSF it will be paid out tax free.

* Tax Rates current as at June 2014.

What you need to know before you get started

Types of insurance that can be held within an SMSF

Consider each member’s need for insurance

Under the SMSF rules, trustees will need to demonstrate that they have properly considered each member’s personal circumstances to determine their insurance needs. For example, in relation to a member, a trustee might consider:

- Their existing insurance arrangements both inside and outside the SMSF

- Their income, expenses, assets and liabilities

- The affordability of cover having regard to their retirement goals

- The availability of cover given their age and health, and

- The impact their death or disability would have on their own/their beneficiaries’ standard of living and their ability to fund ongoing expenses as well as pay any associated medical bills and care costs.

Assess tax on proceeds

Trustees will also need to assess how any insurance proceeds will be taxed when determining the level of insurance required.

What happens if a trustee doesn’t properly consider the insurance needs of members?

Trustees have a legal obligation to consider the need to hold insurance for members and the failure to do so may result in penalties and liability issues applying. However, even more importantly, failing to consider the insurance needs of each member could drastically impact their or their beneficiaries’ standard of living should the member die or become disabled.

How we can help you

Affinity can help you meet your obligations as an SMSF trustee and make sure all of your insurance needs are covered by:

- Undertaking a full insurance needs analysis for each member and provide recommendations on the type and level of insurance required

- Identifying and recommending appropriate insurance policies to hold within an SMSF

- Recommending a contribution strategy to pay any premiums; and

- Updating the SMSF’s investment strategy to reflect that the trustees will consider the need to hold insurance for the members of the fund.

Please contact our office if you would like any further information on any of the topics discussed in this article.