Estate planning involves much more than having an up to date Will. It is important to ensure that your assets are distributed in the most effective manner and without adverse tax consequences for your beneficiaries.

What is estate planning?

Estate planning involves considering what will happen to your assets upon the death of you or your partner. You may want to consider how to structure your estate to ensure it is distributed according to your wishes and ensure your family’s interests are protected and tax minimised.

As part of your estate plan, you will need to consider the following questions:

- Is your Will up to date?

- Do you have adequate life insurance?

- Are there any tax consequences of how your assets are distributed?

- Do you have a binding death nomination for your superannuation? And

- Whether an enduring power of attorney is appropriate for you?

If you own a Business, you may also need to consider implementing appropriate business succession plans.

What is a Will?

A Will is a legal document that sets out who is to receive your assets after you die. A Will may appoint a guardian for any children you have under 18 years of age and also state your wishes regarding your funeral and burial. Your solicitor can help you draft a legal Will. This may involve working with your financial adviser to ensure the appropriate financial structures are included.

Why make a Will?

If you die without a Will (also know as ‘dying intestate’), your assets will be distributed according to the laws of the state or territory in which you lived at the time of your death. This may not be the way you would have wanted your assets distributed. Also, if you have children under 18 who are left without a parent and you don’t have a valid Will appointing a guardian for them, a guardian will be appointed under the laws of the state or territory in which they live. This may not be the person you would have chosen to bring up your children. Both these reasons make it vital for you to have a valid Will and keep it current.

What assets are governed by a Will?

The majority of a person’s assets, including possessions, property, money in bank accounts, shares and managed funds will, upon their death, become part of their estate and be governed by their Will. It’s important therefore to ensure your assets are owned in the appropriate way to avoid being caught by stamp duty or capital gains tax (CGT) if these assets later need to be transferred to a beneficiary.

What assets are not governed by a Will?

Not all the assets you own or control can be dealt with under your Will. These include the following three areas:

Joint tenancy and tenancy in common

Jointly owned assets or property can be held in one of two ways – either as joint tenants or as tenants in common. If an asset is held as joint tenants, on your death the surviving joint tenant automatically acquires ownership of your share of the asset. The asset won’t form part of your estate and can’t be dealt with under your Will. However, if an asset is held as tenants in common, your share of the asset becomes part of your estate and can be dealt with under your Will.

Assets owned by a company or held in trust

If you own assets via a company or trust, your estate plan needs to address how that control will be passed on to your beneficiaries when you die.

In the case of a company, this will involve considering who will be entitled to any shares you own in the company on your death. It may also require an examination of any rights you may have under the constitution of the company to appoint directors.

In the case of a trust, you will need to examine any rights you may have under the trust deed to appoint a replacement trustee or to wind up the trust and direct how its assets should be disposed of. If the trustee is a company, it will also involve considering who would be entitled to any shares you own in that company.

Superannuation death benefits

Many people wrongly assume that their superannuation will pass to their beneficiaries according to their Will. In fact, this will only happen if your estate is the recipient of your superannuation death benefit. Legally, your superannuation fund can pay your death benefit to your spouse, and any of your dependants or your estate, at its discretion. Many (although not all) superannuation funds allow you to override this situation by making what is known as a Binding Death Benefit Nomination. This is a written nomination made by you, which directs your superannuation fund on how to pay your death benefit. There are several types of death benefit nominations, including non-binding options. Your financial adviser can help you decide which is best for our situation.

As part of your estate plan, you also need to consider the taxation implications of how your death benefit is dealt with. Lump sum payments paid to dependants (as defined under income tax laws) are tax-free. Taxable components paid to non-dependants are subject to tax.

Life insurance

When you take out a personal life insurance policy (outside super), you generally have the option to nominate a beneficiary for the policy proceeds. Any payout under the policy will be paid directly to the nominated beneficiary (or beneficiaries), by bypassing your estate. As such, your estate plan should factor in who you have nominated as the beneficiary of your life insurance policy.

It may be prudent to nominate a beneficiary or to have a third party such as a spouse or partner as the owner of the policy rather than simply having the proceeds paid to your estate (unless a testamentary trust is required). This is because a life insurance company will generally require a grant of probate to make a payment to a deceased estate for life insurance proceeds of $50,000 or more, whereas in the case of a nominated beneficiary or a third party owner, usually all that is required is a copy of the death certificate.

Testamentary trusts

A testamentary trust is a trust established by someone’s Will. It comes into existence only when that person dies. Including a testamentary trust in your Will can be useful for making tax effective distributions to beneficiaries under 18, caring for children or a dependant who is incapacitated, and preventing beneficiaries from inappropriately spending their inheritance.

Power of Attorney

If you are worried that you will be unable to manage your own affairs, you might consider implementing a Power of Attorney (PoA)*. Granting someone a PoA means they can legally act on your behalf.

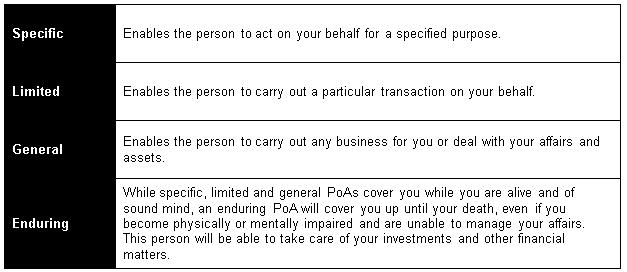

There are four types of PoAs:

Tax effective estate planning

The disposal of assets in accordance with your Will may have tax consequences, including capital gains tax (CGT), that you should consider when drafting your Will and creating your estate plan. There are many strategies you can use to help make your estate plan as tax-effective as possible for your dependants and beneficiaries.

For example:

- The proceeds of an insurance policy paid from a superannuation fund are tax-free if paid to tax dependants.

- Distributing an asset (rather than the proceeds of the sale of that asset) to a beneficiary can defer any CGT liability.

- Using discretionary trust can help minimise the tax a beneficiary pays on receipt of an inheritance.

- Using testamentary trusts can be an effective way to provide an inheritance to young children.

Your financial adviser can help you investigate which strategies may be appropriate for your personal situation.

* The powers that a Power of Attorney (PoA) may confer on another person may differ between the various states and territories of Australia. It would be prudent to seek professional legal advice if you intend to make a PoA.