Introduction

1. A testamentary trust is simply a trust established pursuant to a will. Most testamentary trusts are similar to ‘normal’ discretionary trusts established during the life time of a person, complete with classes of potential beneficiaries, extensive powers and unfettered discretions given to the trustees as to distributions of income and capital.

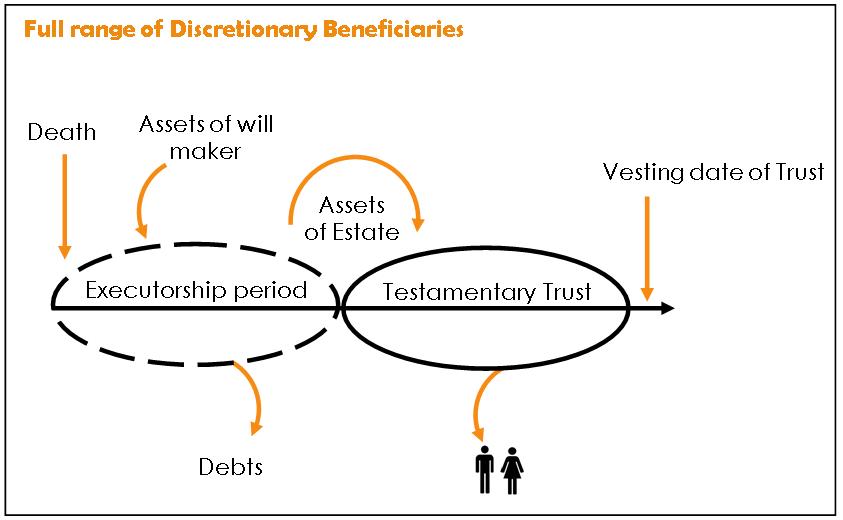

2. A timeline of the administration of an estate and testamentary trust is summarised below.

3. Essentially, the estate is administered by the executor, concluding with the designated assets or portions of the estate then held by the trustee of the testamentary trust.

4. Generally, testamentary trusts are seen as particularly useful in the following circumstances:

(a) to ensure concessional tax treatment is available to distributions of capital and income to infant beneficiaries;

(b) to protect accumulated wealth from wastrel or spendthrift beneficiaries;

(c) to provide for infant children and disabled beneficiaries;

(d) to help protect inheritances from attack by the Family Court and trustees in bankruptcy; and

(e) avoiding an unintended loss by a beneficiary of their Government sourced pension or other benefits (there is limited scope for this).

5. Often testamentary trusts are structured to limit the range of beneficiaries to ‘lineal descendants’, whereby the will maker restricts the discretionary powers of the trustee so they may only distribute income or capital (or both) to the will maker’s children and grandchildren, excluding any spouse of the children and/or grandchildren.

Why use a lineal descendant trust? (LDT)

6. Many parents are concerned that the inheritance they leave to their children could end up in the hands of a son-in-law or daughter-in-law if their child’s marriage breaks down. A properly drafted LDT can assist in keeping an inheritance out of the reach of the Family Court where a beneficiary is involved in a family law property dispute.

7. If a child receives an inheritance in their own name, that inheritance will generally be intermingled with the child’s other assets (e.g. by paying off a mortgage) and, thus, will become ‘matrimonial property’ available for distribution by the Family Court.

8. However, if each child receives their inheritance in a separate LDT, those assets can be kept apart and protected from direct distribution.

9. How successfully the assets are protected depends on how the will and LDT are drafted, and the circumstances at the time of drafting and when a relationship of a beneficiary breaks down.

Estate Planning and Asset Protection

10. For those who have put in place ‘asset protection’ strategies or who could be facing bankruptcy, receiving an inheritance can cause a problem. People in financially high risk occupations such as professionals, business owners and company executives, will often prefer not to receive inherited assets in their own name.

11. If an estate is left to an individual absolutely then it is their property and can be jeopardised by their financial position at the time of the will maker’s death, or at any time in the future. Should a person suffer financial misfortune, the testamentary trust provides a facility whereby the inheritance can be protected.

Tax planning

12. In Australia, death is not viewed as a tax planning strategy. It is, therefore, possible to draft a testamentary trust so as to ensure that any income allocated to minor children is not subject to the same tax rates as if it were a trust established during a person’s lifetime. In particular, under a family trust created during a person’s life the first $400 distributed to a child is tax free but then any further income is taxed at the highest rate, which in some circumstances can be as much as 66%.

13. Income derived by infant children via a testamentary trust however is assessed at the normal, individual adult rates (the first $24,000 (approximately) tax free and the balance taxed at marginal rates) which for most families will mean significant tax planning opportunities.

Other benefits

14. In addition to the tax planning and asset protection benefits outlined above, appropriately structured testamentary trusts can also achieve numerous other objectives including:

(a) facilitating ‘generation skipping’ by ensuring that the majority of wealth passes to a will maker’s grandchildren, as opposed to their children;

(b) providing a structure within which it is possible to provide disproportionately for particular beneficiaries, for example, the trustees could have discretion to increase entitlements for those beneficiaries with special needs and decrease distributions to spend thrift or ‘at risk’ beneficiaries; and

(c) creating the ability to structure multiple testamentary trusts under a single will, with each trust tailored to achieve particular objectives in relation to the intended beneficiaries of that trust.